It’s possibly one of the UK’s most loathed taxes; therefore most of us rejoiced last week when Chancellor Rishi Sunak made all property purchases up to £500,000 exempt from Stamp Duty Land Tax, adding to the measures already in place to help soften the economic impact of recent events.

During this so-called Stamp Duty ‘holiday’, set to last until 31 March 2021, the average buyer will pay no stamp duty when purchasing their home (based on Land Registry average house price[i] of £247,355).

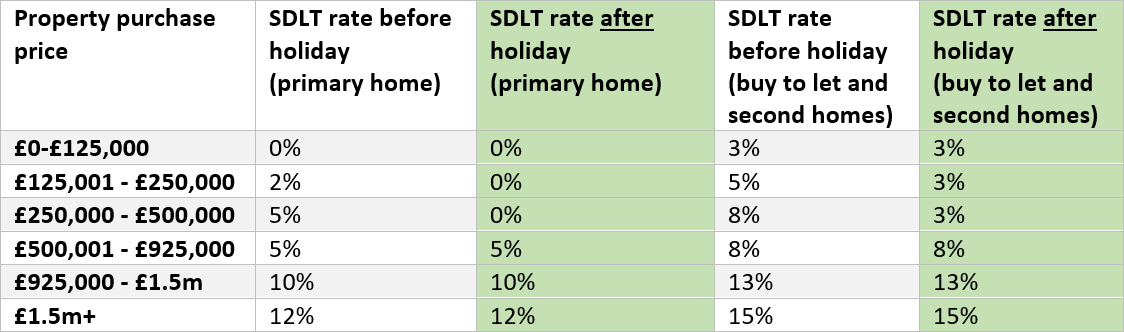

Stamp Duty will only become payable after the value of a purchase hits the half a million-pound mark, or if you are buying a second home or buy to let property. Even in these cases, buyers will experience a significant saving, as we have outlined below.

Source: Daily Mail

Anyone buying a primary home between the values of £600,000 and £1.5m is set to save £15,000 on their purchase, offering a clear window of opportunity to capitalise on a significant tax saving by acting soon.

When it comes to buy to let and second homes, the SDLT holiday also applies, as our table below shows:

Source: Daily Mail[ii]

The changes have been in place just a matter of days and already our team of expert advisers has seen a spike in enquiries from buyers eager to capitalise on these saving whilst they can.

If you’re looking to do the same, please don’t hesitate to get in touch with our team, who can help with a huge variety of financing solutions, from buy to let mortgages and expat lending, to commercial finance and equity release.

Whether you are looking to finance your first home, expand your portfolio or embark on a new development, talk to the experts in large and specialist finance.